The latest World Bank report makes pretty dry reading. It starts by re-iterating the drivers for stagflation, which are pretty well known. To recap

The world economy continues to suffer from a series of destabilizing shocks. After more than two years of pandemic, the Russian Federation’s invasion of Ukraine and its global effects on commodity markets, supply chains, inflation, and financial conditions have steepened the slowdown in global growth.

I’m more interested in the results. In particular, what exactly are the stagflation expectations, quantitatively?

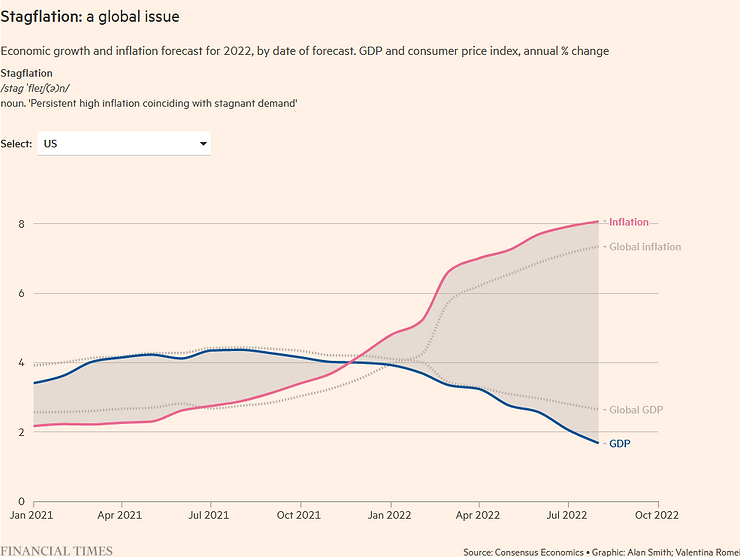

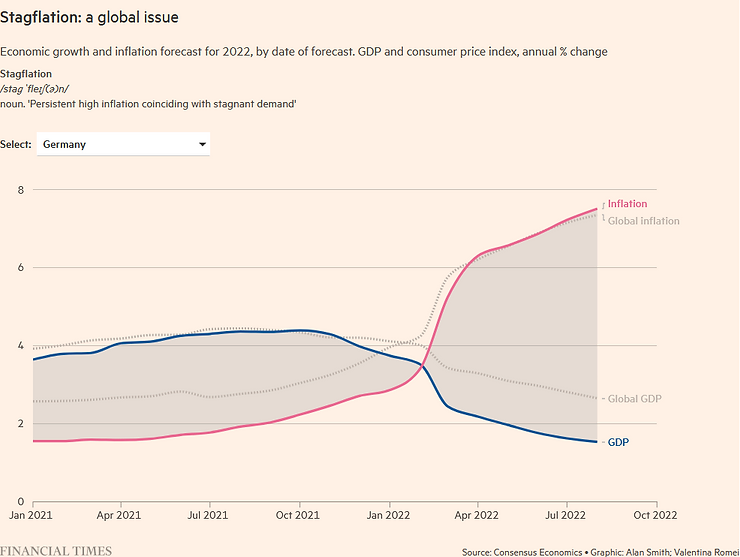

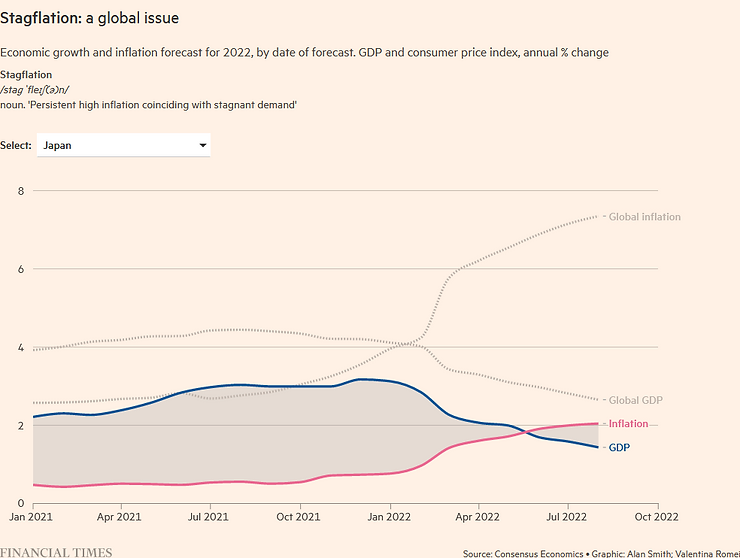

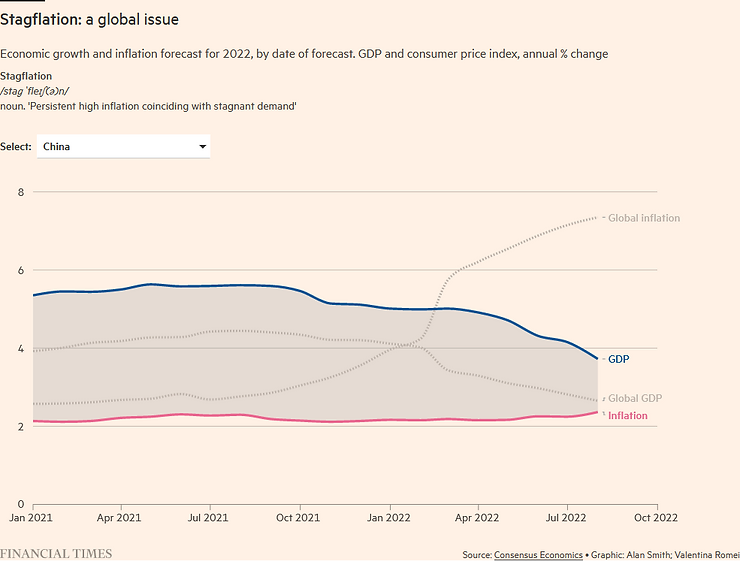

To summarize and quantify the GDP and inflation expectations, our team analyze the major economies, including the US, China, Japan and Germany.

US inflation trending higher while GDP trending lower:

Germany took a dramatic, negative turn since the war in Ukraine:

Japan has been enduring below-global average growth, low-inflation for decades now. What make recent changes remarkable is that inflation forecast outpace GDP fore the first time in years:

Compared with the US, China benefits from very low inflation, partly due to the capital control and pricing control regime. Nevertheless, zero-COVID policy, Sino-American trade wars, uncertainty with the plenary meetings, etc. continue to drive down GDP expectations.

So what?

In the next blog post, we may discuss the implications and strategies.

Check out the full interactive chart contrasting GDP and inflation:

https://www.brinknews.com/quick-take/risk-of-stagflation-rises-around-the-world/